35+ Current 15 year mortgage calculator

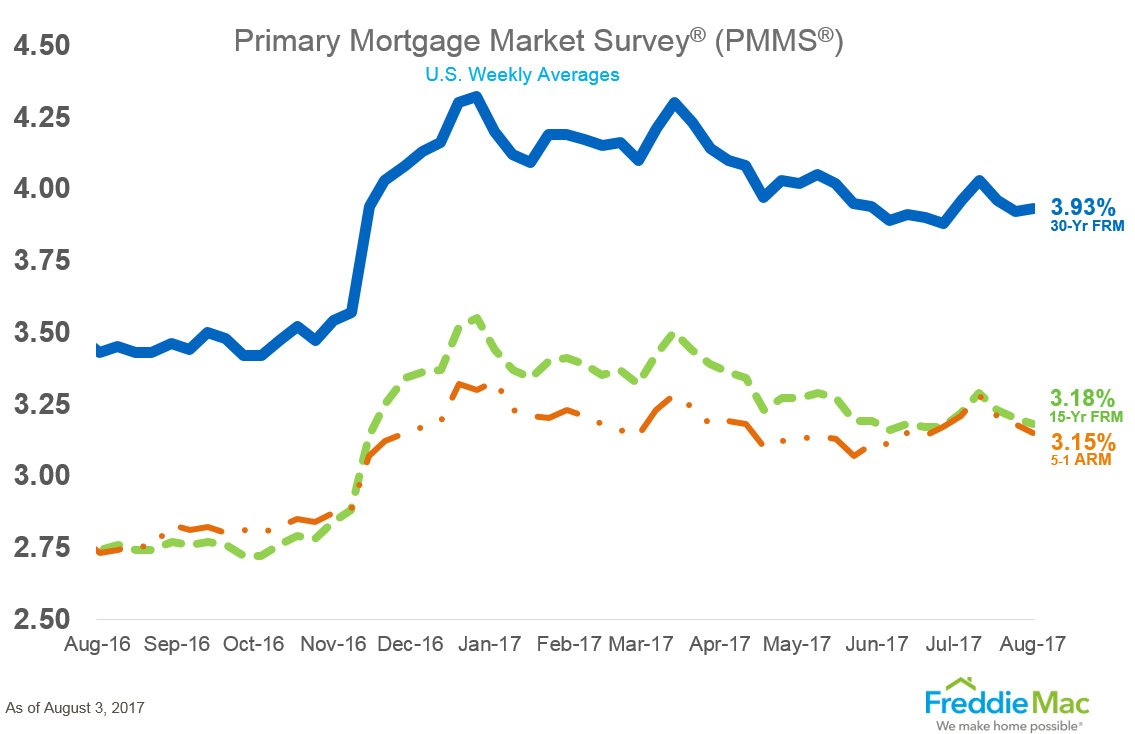

Choose from 30-year fixed 15-year fixed and 5-year ARM loan scenarios in. Enter your expected down payment.

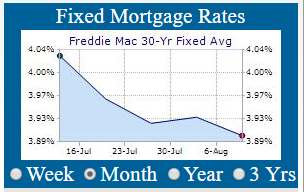

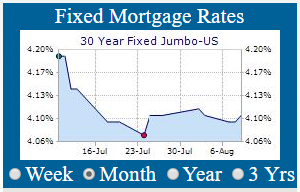

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Its Never Been A More Affordable Time To Open A Mortgage.

. 21 hours agoThe current average 30-year fixed mortgage rate is 589 according to Freddie Mac. The 30-year fixed-rate mortgage. Loan Amount and Rate Factors.

Calculate your adjustable mortgage payment. Provide the homes purchase price. The average interest rate for a 15-year mortgage is currently 523 compared to the 30-year mortgage rate of 603.

View a 125000 loan amortized over 15 years. This free mortgage tool includes principal and interest plus estimated taxes insurance PMI. The number of years over which you will repay this loan.

View a 100000 loan amortized over 15 years. Here are the steps to take with the NerdWallet 15-year mortgage calculator. The current average 10-year mortgage rate is 552 compared to 532 a week before.

What is a 10-year fixed-rate. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. 300000 - APR 214.

Pros of a 35. There are options to include extra payments or annual. The loan amount the interest rate and the term of the mortgage can have a dramatic effect on the total amount.

With a 15-year mortgage youll own a home much faster and save a lot of money but you ll face higher monthly payments. There are more drawbacks than benefits to a 35-year mortgage and weve listed all the pros of cons of a 35-year mortgage. View a 150000 loan amortized over 15 years.

451 rows Pros and cons of a 35-year mortgage. This type of 15-year mortgage has a fixed interest rate. Use our simple mortgage calculator to quickly estimate monthly payments for your new home.

Pros and cons of a 35-year mortgage. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which. Our calculator defaults to the current average rate but you can adjust the percentage.

Use our free mortgage calculator to estimate your monthly mortgage payments. 197 rows This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual. Since youre considering a 15-year loan.

08082016 Bank of England Base Rate. A 15-year fixed-rate. This type of 15-year.

15 year mortgage chase current 15 year mortgage rates 15 year mortgage calculator mortgage calculator 15 year mortgage fha 15 year mortgage rates average 15 year mortgage rate 15. This is an increase from last week when it was at 566.

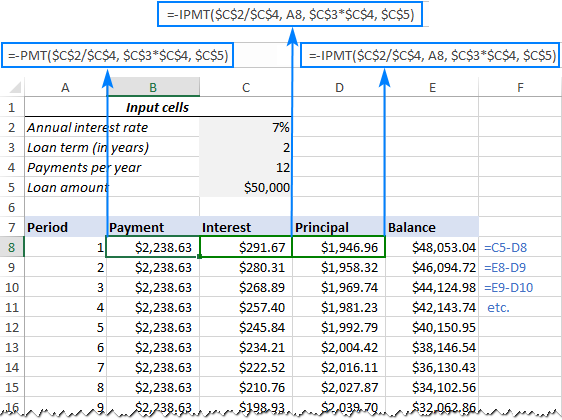

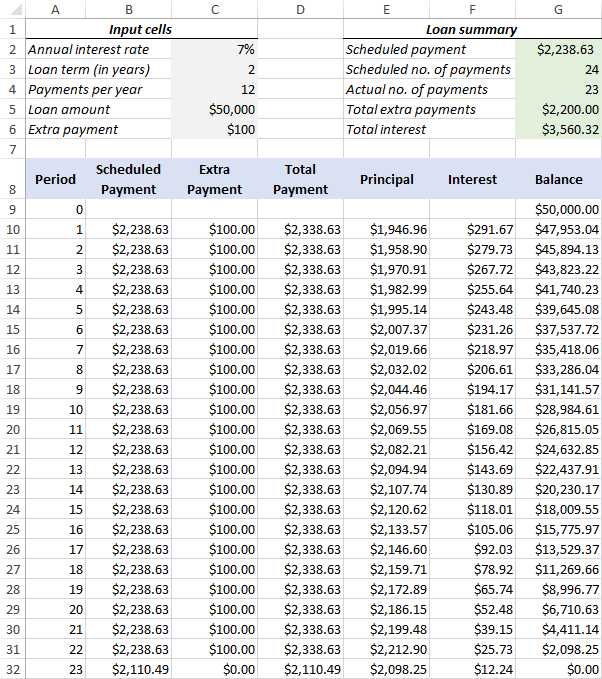

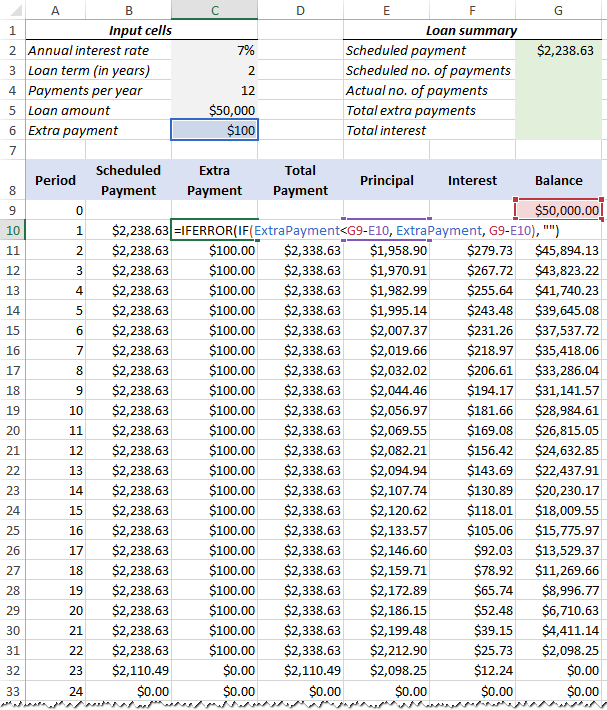

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Your Adjustable Rate Mortgage Needs To Be Refinanced

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

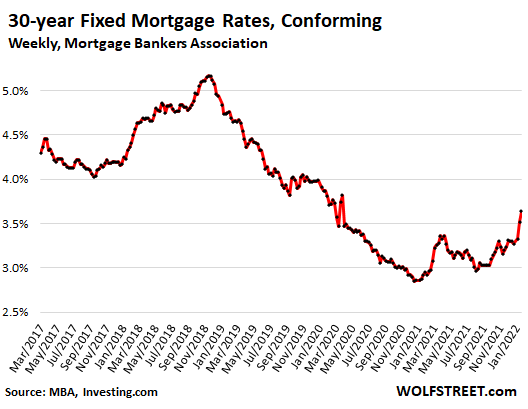

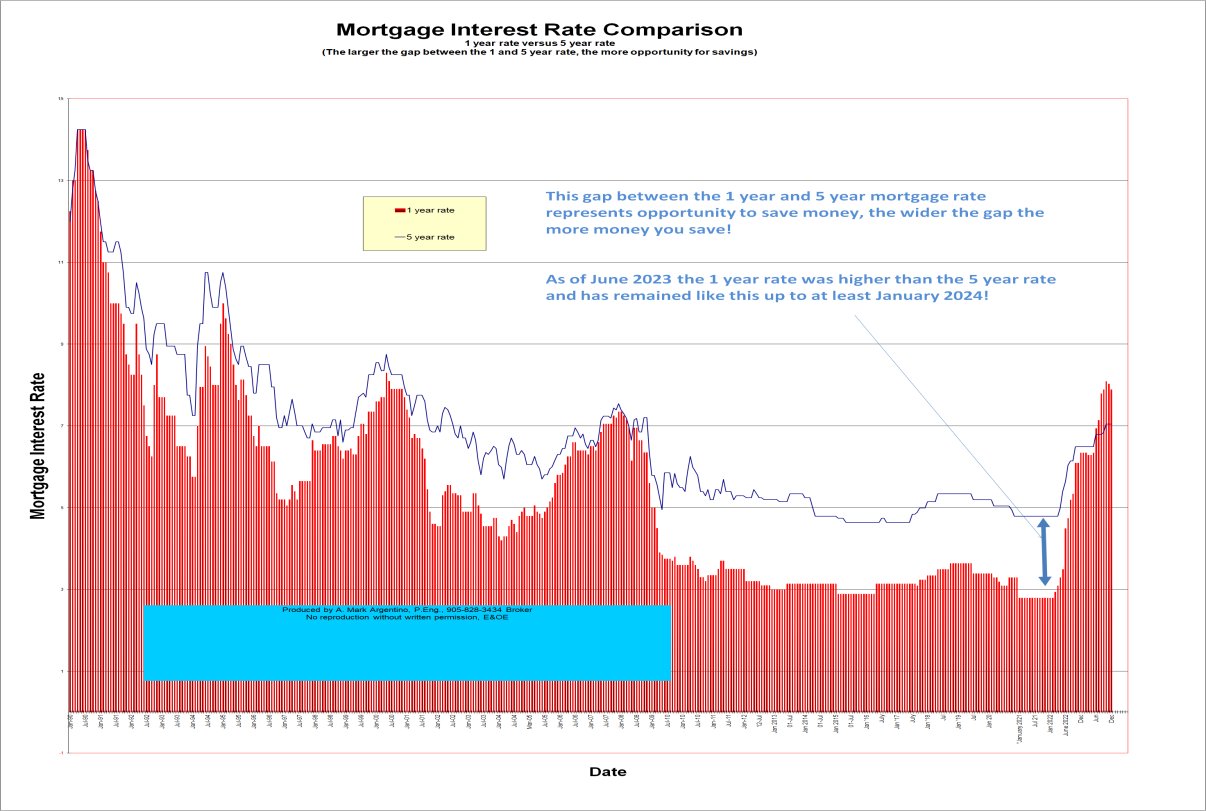

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

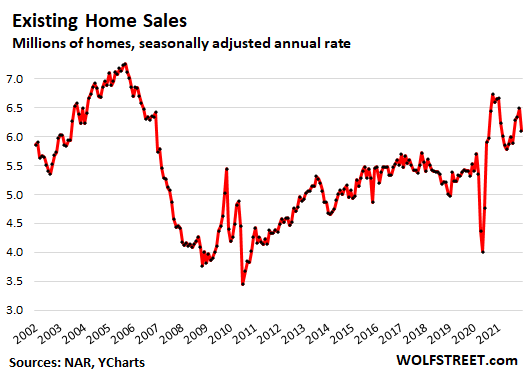

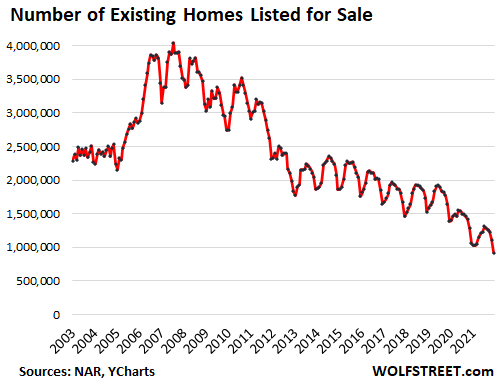

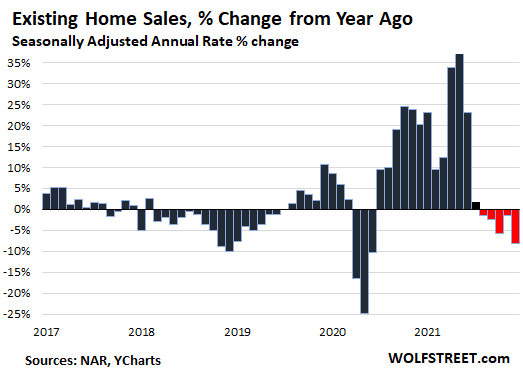

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Will Rising Interest Rates Kill Atlanta S Hot Housing Market Atlanta Ga Patch

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Interest Rates Mississauga Real Estate Mls

Your Adjustable Rate Mortgage Needs To Be Refinanced

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street